Diversify your financial defense using proven offshore trusts asset protection tactics.

Diversify your financial defense using proven offshore trusts asset protection tactics.

Blog Article

Essential Insights on Offshore Count On Property Security Solutions for Capitalists

When it comes to shielding your wide range, overseas trust funds can be a necessary solution. What specific elements should you consider to ensure your overseas count on serves your rate of interests effectively?

Understanding Offshore Trusts: A Thorough Summary

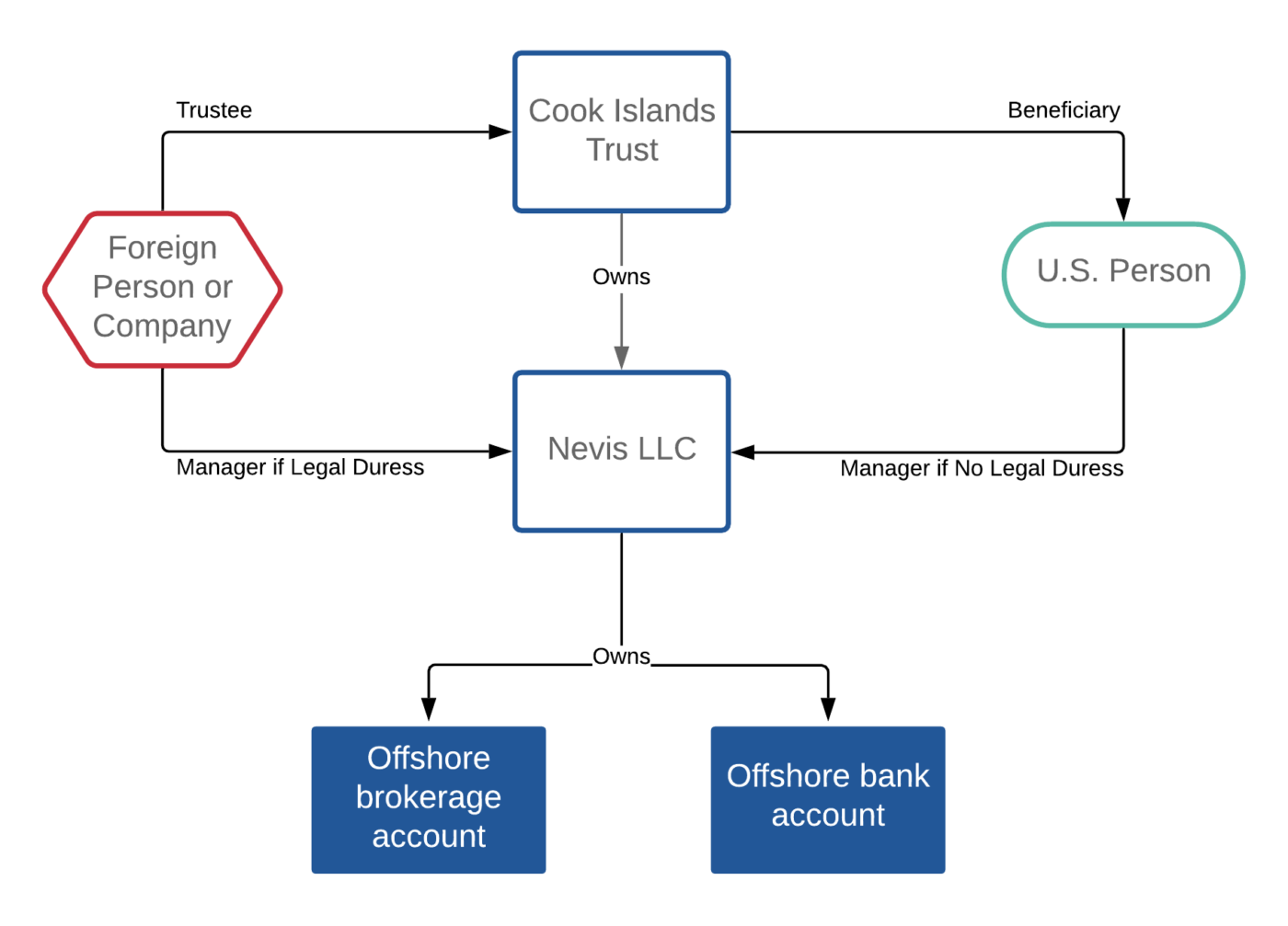

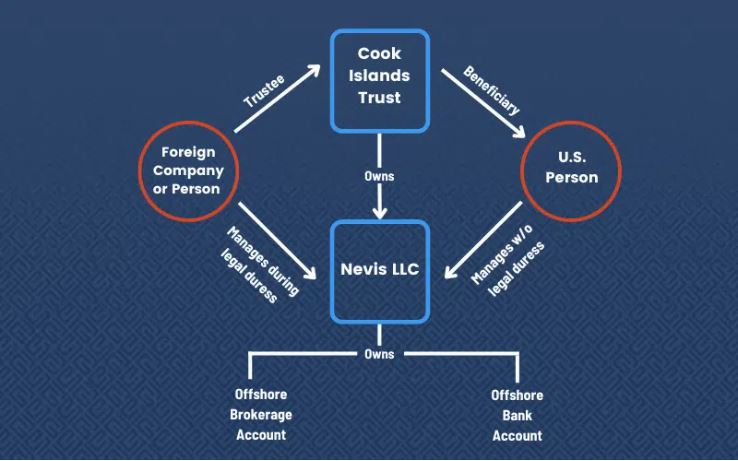

When thinking about asset protection, understanding offshore trusts is necessary. Offshore trusts are lawful entities established in territories outside your home country, created to protect your possessions from possible threats. You can create these trusts for various reasons, such as privacy, wealth administration, and, most notably, protection versus financial institutions and legal claims.

Normally, you mark a trustee to handle the trust, making certain that your assets are managed according to your dreams. This splitting up in between you and the assets helps protect them from legal vulnerabilities and potential financial institutions.

While developing an offshore depend on may entail first costs and complexity, it can provide tranquility of mind recognizing your riches is secure. You'll intend to thoroughly research various jurisdictions, as each has its very own laws and tax ramifications. Understanding these subtleties will equip you to make educated decisions regarding your property security approach.

Key Benefits of Offshore Trust Fund Property Defense

When you think about offshore count on possession security, you disclose substantial benefits like boosted privacy measures and tax obligation optimization strategies. These benefits not only guard your wide range yet likewise offer you with greater control over your economic future. offshore trusts asset protection. Comprehending these key advantages can assist you make informed choices concerning your possessions

Enhanced Personal Privacy Procedures

Although you could already know the monetary advantages of offshore trust funds, among their most compelling attributes is the improved personal privacy they offer. By positioning your assets in an offshore trust fund, you protect your riches from public analysis and potential lenders. This level of confidentiality is particularly beneficial in today's globe, where personal privacy is significantly in danger.

You can select jurisdictions with strict privacy laws, ensuring your economic affairs stay very discreet. Offshore depends on can also aid you different personal and organization properties, additionally shielding your identity and interests. This personal privacy not only safeguards your assets however also offers satisfaction, enabling you to focus on your investments without the stress and anxiety of undesirable focus or disturbance.

Tax Obligation Optimization Approaches

Legal Frameworks Governing Offshore Counts On

Understanding the lawful structures governing offshore trust funds is necessary for anybody contemplating this possession defense strategy. offshore trusts asset protection. These structures vary considerably across jurisdictions, so it is necessary to familiarize yourself with the guidelines and needs in your picked location. The majority of overseas counts on operate under the legislations of certain countries, often created to provide favorable conditions for possession protection, personal privacy, and tax obligation effectiveness

You'll require to examine variables such as trust fund registration, trustee obligations, and beneficiary civil liberties. Conformity with international legislations, such as anti-money laundering policies, is likewise important to stay clear of lawful problems. In addition, some jurisdictions have certain regulations pertaining to the validity and enforceability of depends on, which can impact your general technique.

Choosing the Right Territory for Your Offshore Trust Fund

Exactly how do you select the best jurisdiction for your overseas depend on? Take into consideration the lawful framework. Search for countries with durable asset protection regulations that align with your goals. You'll also want to review the political and financial security of the territory; a steady setting reduces threats to your possessions.

Next, examine tax implications. Some jurisdictions provide tax obligation advantages, while others might enforce high tax obligations on count on revenue. Pick a location that optimizes your tax obligation effectiveness.

Another vital element is the track record of the territory. A well-regarded location can boost the integrity of your trust fund and offer comfort. Believe concerning availability and the high quality of neighborhood service carriers. Having trustworthy lawful and financial consultants can make a substantial distinction in managing your count on efficiently.

Common Sorts Of Offshore Trusts and Their Usages

When thinking about offshore counts on, you'll come across numerous kinds that offer different purposes. Revocable and irrevocable counts on each offer one-of-a-kind benefits relating to flexibility and asset protection. Furthermore, asset protection trust funds and charitable remainder counts on can aid you protect your wealth while supporting reasons you appreciate.

Revocable vs. Irrevocable Counts On

While both revocable and irreversible counts on serve necessary functions in offshore asset protection, they function quite in a different way based on your objectives. A revocable count on allows you to maintain control over the possessions during your lifetime, letting you make adjustments or withdraw it totally. This adaptability is wonderful if you want access to your properties, but it does not provide solid security from lenders because you're still taken into consideration the proprietor.

In contrast, an irrevocable trust fund transfers ownership of the possessions far from you, giving a more powerful guard against financial institutions and lawful claims. When developed, you can't conveniently modify or withdraw it, but this durability can boost your property defense technique. Selecting the best kind depends on your certain needs and lasting goals.

Asset Defense Counts On

Asset protection trust funds are vital tools for securing your wide range from potential creditors and legal claims. One usual kind is the Residential Asset Protection Depend On (DAPT), which permits you to retain some control while protecting properties from financial institutions. Another alternative is the Offshore Possession Security Trust fund, usually set up in jurisdictions with solid privacy laws, giving better security versus lawsuits and financial institutions.

Charitable Remainder Counts On

Charitable Remainder Trust Funds (CRTs) supply an one-of-a-kind means to attain both philanthropic goals and economic benefits. By establishing a CRT, you can donate possessions to a charity while preserving revenue from those possessions for a specific period. This strategy not just sustains a philanthropic reason but additionally offers you with a possible revenue tax reduction and helps in reducing your taxed estate.

You can pick to get income for a set term or for your life time, after which the remaining properties most likely to the marked charity. This see this page twin advantage allows you to delight in financial versatility while leaving a long lasting impact. If you're looking to stabilize charitable objectives with individual financial requirements, a CRT could be an optimal service for you.

Potential Mistakes and Dangers of Offshore Counts On

Although overseas trusts can supply significant advantages, they aren't without their potential pitfalls and threats. You could encounter greater costs associated with developing and keeping these depends on, which can eat right into your returns. Additionally, navigating via complex lawful structures and tax guidelines in different territories can be frustrating. If great post to read you do not adhere to regional legislations, you might expose yourself to lawful charges or asset seizure.

Finally, not all offshore jurisdictions are developed equal; some might lack durable securities, leaving your assets at risk to political or economic instability.

Actions to Establish Up and Manage Your Offshore Depend On

Setting up and handling your offshore trust fund requires mindful preparation and execution. Pick a reliable offshore jurisdiction that lines up with your goals, considering elements like tax advantages and legal defenses. Next, choose a trustworthy trustee or depend on company experienced in handling overseas trust funds. After that, prepare the trust fund deed, outlining the terms, beneficiaries, and possessions included. It's crucial to money the trust appropriately, transferring possessions while adhering to legal requirements in both your home country and the offshore territory.

When established, consistently review and update the trust fund to reflect any changes in your economic scenario or family members characteristics. By complying with these steps, you can protect your properties and accomplish your financial goals properly.

Frequently Asked Questions

Just How Much Does Establishing an Offshore Trust Fund Normally Expense?

Establishing an offshore trust normally sets you back in between $3,000 and $10,000. Elements like intricacy, jurisdiction, and the company you more pick can influence the total cost, so it is essential to research your alternatives extensively.

Can I Be the Trustee of My Own Offshore Count On?

Yes, you can be the trustee of your own offshore count on, but it's usually not advised. Having an independent trustee can supply additional possession security and credibility, which could be helpful for your monetary technique.

What Takes place to My Offshore Count On if I Relocate Countries?

If you move nations, your offshore trust fund's lawful standing might transform. You'll require to take into consideration the new territory's regulations, which may affect tax implications, reporting requirements, and possession protection. Consulting a legal expert is crucial.

Are Offshore Trusts Based On U.S. Taxes?

Yes, offshore trust funds can be based on united state tax obligations. If you're a united state taxpayer or the depend on has U.S. assets, you'll require to report and perhaps pay taxes on the earnings generated.

Exactly How Can I Accessibility Funds Kept In an Offshore Trust?

To access funds in your overseas trust fund, you'll commonly require to adhere to the trust fund's distribution guidelines. Consult your trustee for details treatments, and validate you understand any kind of tax ramifications before making withdrawals.

Final thought

To conclude, offshore counts on can be effective tools for safeguarding your properties and safeguarding your wide range. By comprehending the advantages, lawful frameworks, and sorts of trust funds readily available, you can make enlightened choices concerning your financial future. Choosing the appropriate jurisdiction is important, so take your time to research and seek advice from with experts. While there are risks included, the comfort and security that come with a well-structured overseas depend on commonly surpass the prospective disadvantages.

Report this page